15+ 300000 mortgage

This includes estimated property taxes insurance premiums for risks such as fire and theft and mortgage insurance payments. Adjustable Rate Mortgage Rates.

Here S A Budget Breakdown Of A Couple That Makes 500 000 A Year And Still Feels Average Make It Money

Filo Mortgage is proud to offer amazingly low rates to those looking to refinance or purchase a home.

. Assuming you have a 20 down payment 60000 your total mortgage on a 300000 home would be 240000. 8000 in interest payments. For today Wednesday September 14 2022 the national average 15-year fixed refinance APR is 5570 up compared to last weeks of 5380.

When you make your big 10000 payment toward the principle FYI be sure they always. For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 1078 monthly payment. Extra Payment Loan Types and Points.

All Rates Effective September 13 2022 at 1000 am. With a 300000 mortgage the payment is roughly 1300 a month 500 goes to the mortgage principle and 800 goes toward the interest. Heres a breakdown of what you might face monthly in interest and over the life of a 200000 mortgage.

Due to rate volatility please contact a mortgage lender for an accurate rate quote for your mortgage. We understand that the interest rate on a mortgage can make the difference between your ability to afford a home or not. Table of Contents 300000 monthly mortgage payment.

If youre looking to buy a property with a 300000 mortgage a broker who specialises in this bracket size is best placed to help you. Learn more mortgage loan rates and see payment details. Get matched with a broker experienced in 300000 mortgages today.

Check rates today to learn more about the latest 15-year mortgage rates. 15 Must-Know Outsourcing Statistics for 2022. 30-year fixed rate.

Credit Cards for 600 Credit Score. Median gross rent 2016-2020. 300000 350000 400000 450000 500000 550000 600000 650000.

The fourth and final Nasdaq 100 stock that can turn 300000 into 1 million by 2029 is yet another FAANG stock Meta Platforms META-835. They have relationships with all the lenders and know exactly who to approach based on your particular circumstances. 15 Year Jumbo Fixed.

Rates are subject to change during the day without notice. Talk to your contractor to get. Afford a 15-year loan term or whether you.

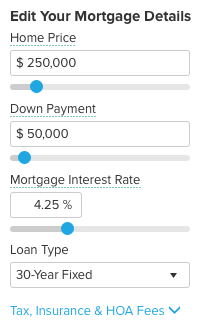

At a 4 fixed interest rate your monthly mortgage payment on a 30-year mortgage might total 95483 a month while a 15-year term might cost a month. Before you start punching numbers into a calculator however you need to have a budget. If you happen to have a new loan worth 300000 you can try recasting.

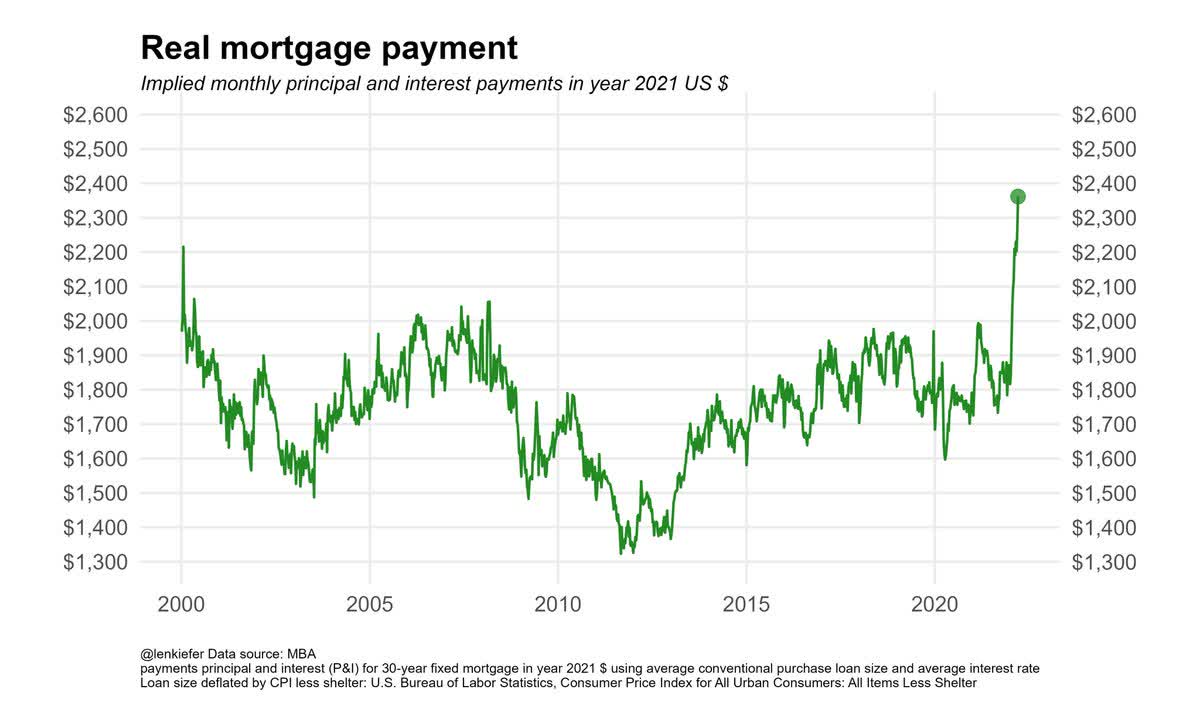

From 180000 to nearly 300000. Monthly payments for a 300000 mortgage. The amount youll pay each year to borrow the money expressed as a percentage.

5-YR ARM 5375 5239 APR Lender Fees. Estimates are based on single family owner occupied 760 credit score purchase. For example a 30-year mortgage for a 300000 home.

Where to get a 300000 mortgage. A 15-year fixed-rate mortgage has a 15-year term with a fixed interest rate and payments while a 5-year ARM has a longer 30-year term with a fixed-rate for the first 5 years and then a variable rate for the remaining term. Adjustable Rate Mortgage Loans.

If you owe 150000 on a home that cost you 300000 and today that home is worth. Note that your monthly mortgage payments. Meta is the company formerly known as Facebook.

If you make 1 extra mortgage payment a year on the 15 year fixed loan you will save. A 15-year mortgage costs you less since the total interest paid is less than a 30-year but there are both pros and cons to a 15-year loan. Todays national 15-year refinance rate trends.

Number of Payments. Most of these costs go to labour while the next biggest expense is sourcing materials. Associated Bank offers a variety of mortgage products.

Learn more about how much a 300000 mortgage will cost you in the long run. You may be able to buy a home on 50000 a year with todays low interest rates and special mortgage programs. 15-YR FIXED 4990 4990 APR Lender Fees 0 Points 0 Get Started.

5000 definition for Interest Rate. If you have a 30-year mortgage you can refinance to a 15-year mortgage with reduced interest. Budget 10-15 on top of the calculated estimate for incidentals and repairs.

Families Living Arrangements. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. Moreover it allows you to shift from a fixed-rate mortgage to an adjustable-rate mortgage ARM and vice versa.

Some experts recommend getting a 15-year mortgage because youll pay far less interest and be debt-free in half the time compared to a 30-year loan. Heres what youll need for a 15-year fixed rate mortgage. In fact on a traditional 15- or 30-year loan of this size you might pay anywhere from 72000 to 155000 just in interest.

A mortgage calculator is a great tool that you can use to see how much you can realistically afford. Rates subject to change at any time. According to Service Seeking minor renovations can cost as little as 20000 but you can easily go over 300000 for a complete transformation.

Monthly payments on a 200000 mortgage. Using the previous example if a 15-year loan monthly payment was 2108 and the 30-year loan monthly payment was 1432 a borrower could invest that 676 difference elsewhere. On a 300000 mortgage those costs might surprise you.

106 and 151 options. 5-year ARMs generally offer a lower initial interest rate compared to fixed-rate mortgages which may save you thousands. You can buy a home worth 330000 with a 30000 down payment and a 300000 mortgage.

Extra payment amount. 15 Must-Know Outsourcing Statistics for 2022. Median selected monthly owner costs -with a mortgage 2016-2020.

Median selected monthly owner costs -without a mortgage 2016-2020. 5 Year ARM Payment Details.

The Minimum Income Necessary To Afford A Five Million Dollar House

How Much Should I Have Saved In My 401k By Age

The Housing Market Bubble Is Cracking Bats Itb Seeking Alpha

How Much Does A Mortgage Loan Officer Make Quora

:max_bytes(150000):strip_icc()/average-what-can-i-expect-my-private-mortgage-insurance-pmi-rate-be.asp-d107c689ce61440b9ccc69363bbc08c0.png)

On Average What Can I Expect My Private Mortgage Insurance Pmi Rate To Be

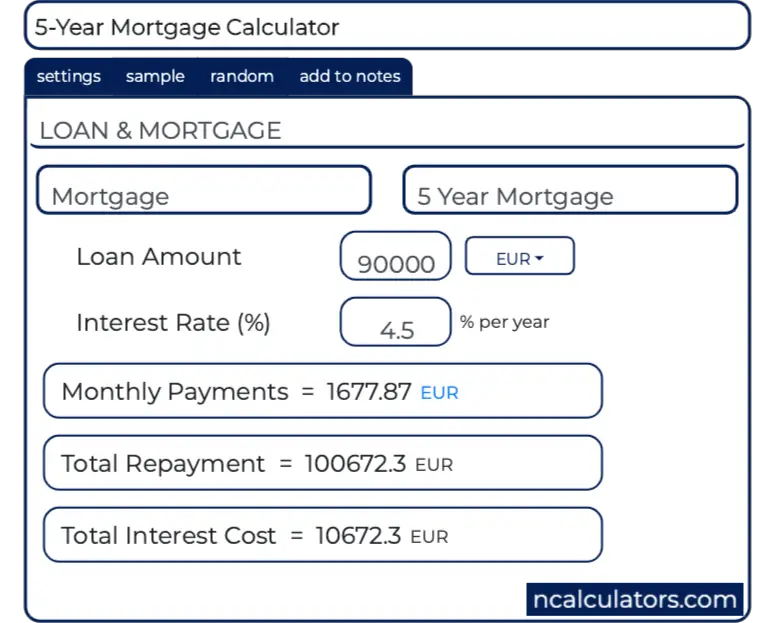

Mortgage Calculator Payment Deals 59 Off Ilikepinga Com

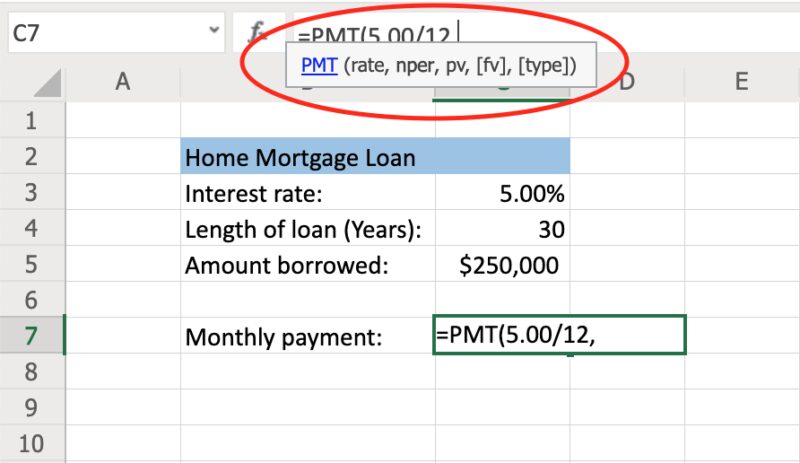

How To Calculate Monthly Loan Payments In Excel Investinganswers

The Minimum Income Necessary To Afford A Five Million Dollar House

Mortgage Calculator Payment Deals 59 Off Ilikepinga Com

/average-what-can-i-expect-my-private-mortgage-insurance-pmi-rate-be.asp-d107c689ce61440b9ccc69363bbc08c0.png)

On Average What Can I Expect My Private Mortgage Insurance Pmi Rate To Be

How Much Does A Mortgage Loan Officer Make Quora

A3bkdb7cbbu0wm

Mortgage Calculator Payment Deals 59 Off Ilikepinga Com

Mark Welti Real Estate Consultant Brookstone Realtors Linkedin

How Much Does A Typical 23 Year Old Person Make And How Much Do They Have In Savings Quora

Why The Median 401 K Retirement Balance By Age Is Dangerously Low

Mortgage Calculator Payment Deals 59 Off Ilikepinga Com