Rsu tax calculator

You only pay tax on RSUs when they vest. Maximum Local Sales Tax.

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

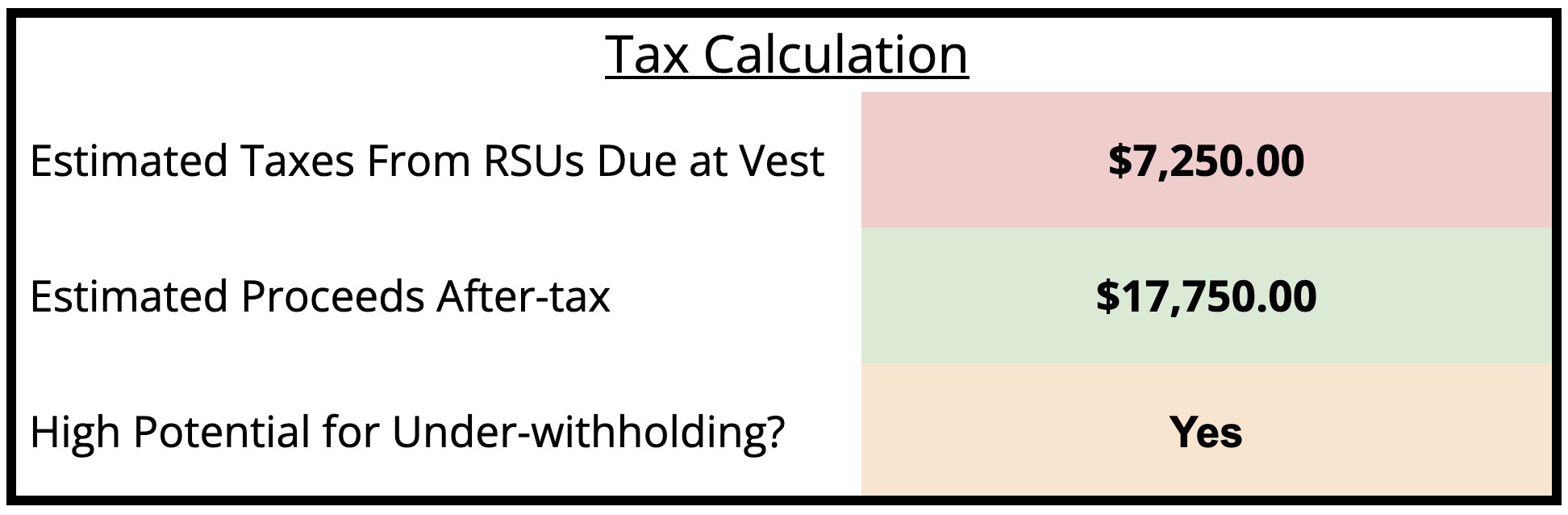

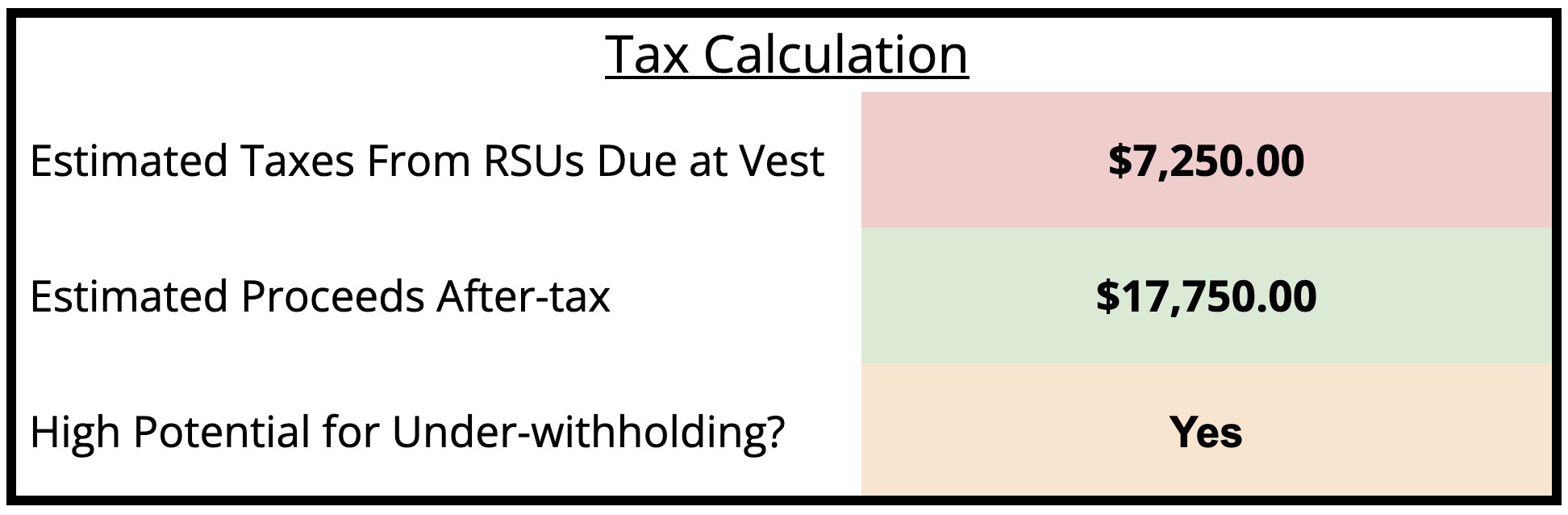

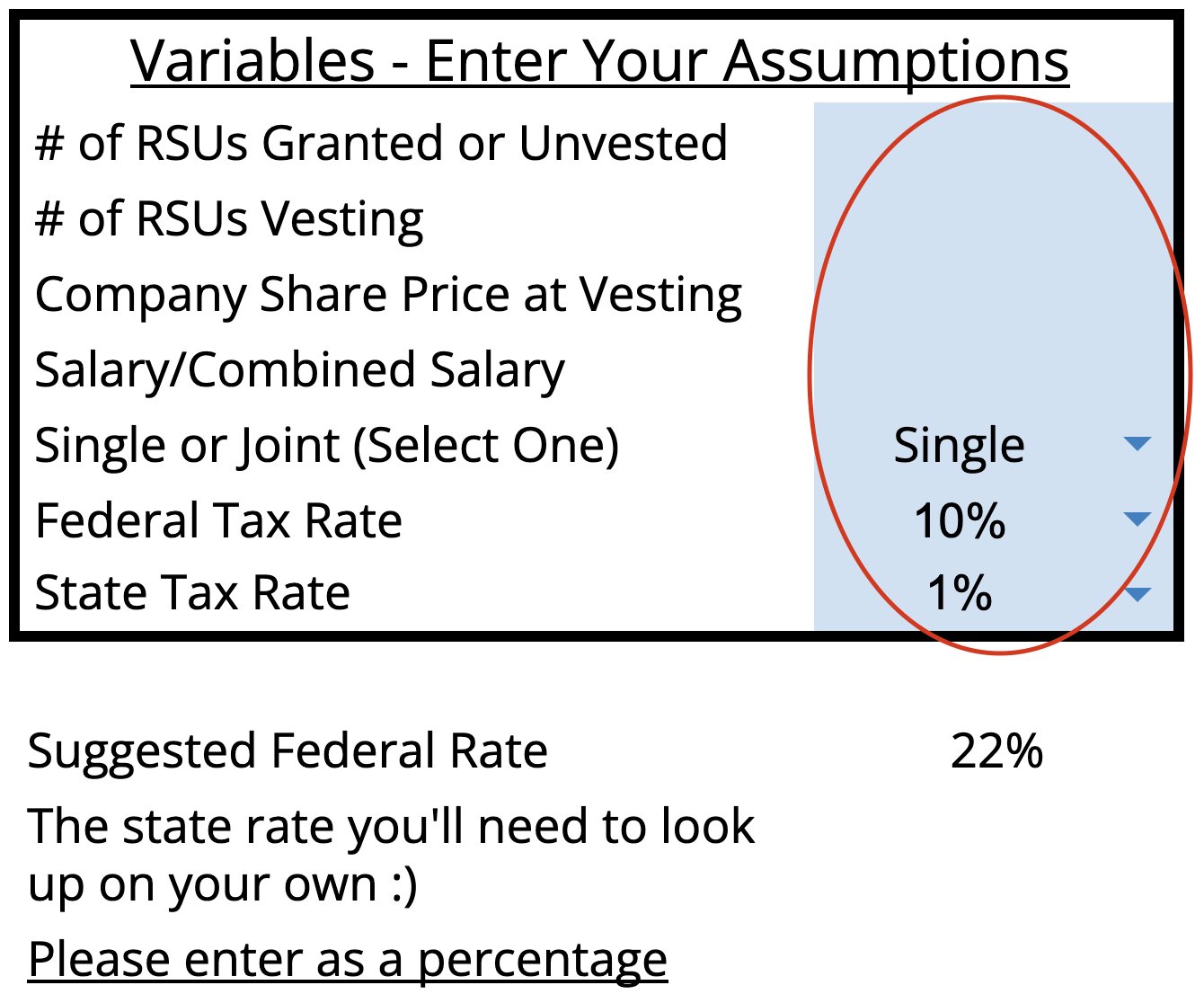

Based on your inputs it will calculate your RSU tax bill if youre likely underwithheld and the amount you potentially still own when you file your taxes.

. Here is an article on employee stock options. The calculator primarily focuses on Restricted Stock Units RSUs. Your earned income is a simple calculation of the stock price on the day of vest multiplied by the number of shares vesting that day.

Our free salary paycheck calculator below can help you. Your household income location filing status and number of personal exemptions. RSU Tax Calculator.

If population exceeds 10 lakhs but up to 25 lakhs. Your average tax rate is 1198 and your marginal tax rate is. California Income Tax Calculator 2021.

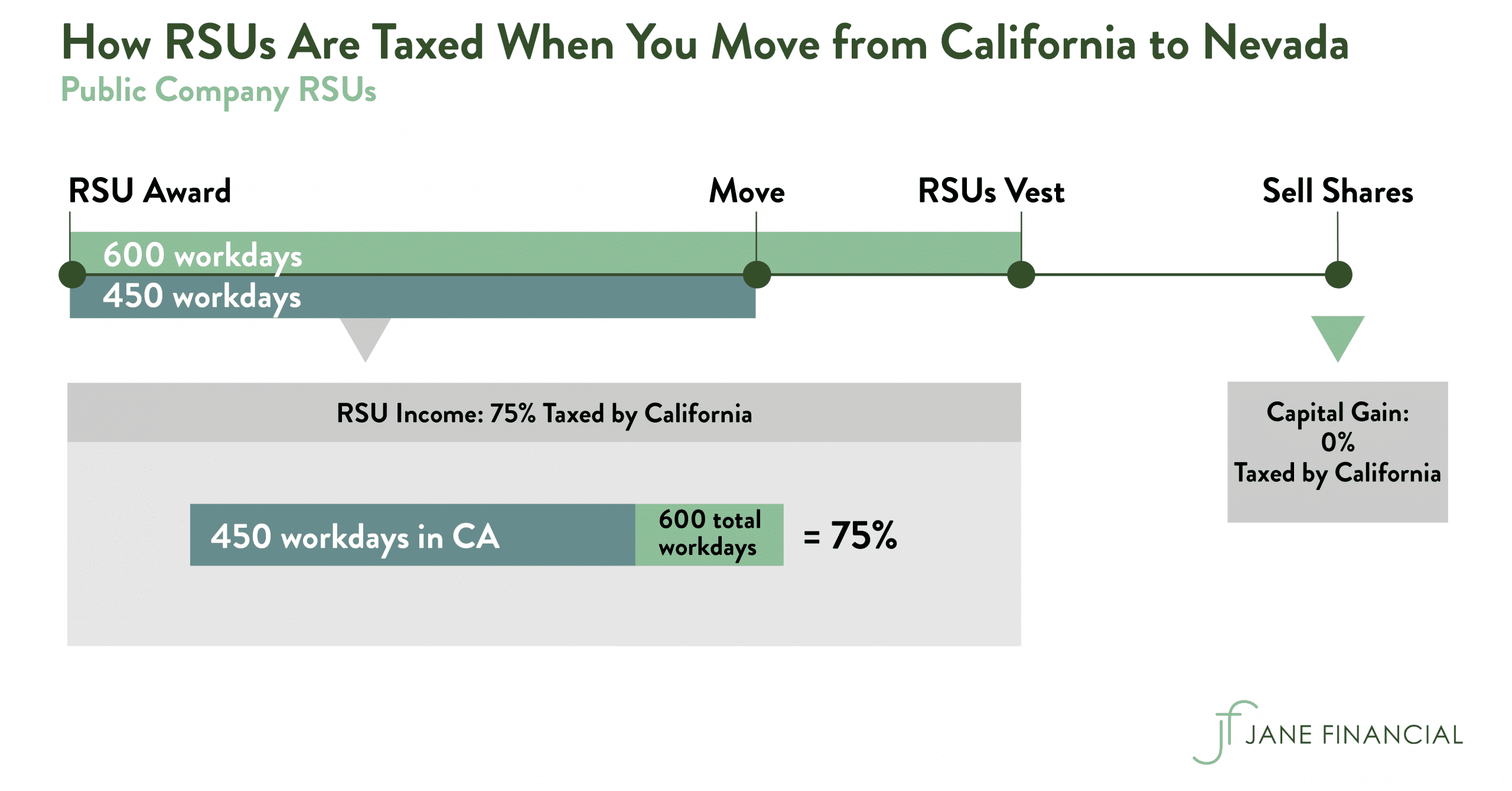

This online calculator allows you to estimate both federal and state taxes due to an IPO or vested RSUs and is especially useful as it takes into account capital gains deductions and existing tax withholdings showing you the additional taxes due that you may need to prepare for. How is tax calculated for RSUs awarded by MNCs outside India. Your employer withholds a 62 Social Security tax and a 145 Medicare tax from your earnings after each pay period.

Here is the information you need to know prior to jumping in. For senior citizens the exempt income is rs 3 lakhs and for super. A restricted stock unit or rsu is a hypothetical share of verizon common stock.

If you live in a state where you need to pay state income taxes repeat steps 2 and 3 using your state marginal tax rate. The timing of rsu tax is exactly the same as any other. We created a free excel tool to help with that.

Maxing out your 401 k may not directly. Qualified espps known as qualified section 423 plans to match the tax code have to follow irs rules to receive favored treatment. Multiply the tax rate from 2 by the gross value of the RSUs that vested and subtract the amount that was already withheld by your employer.

RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. This is different from incentive stock options which are taxed at the capital gains rate and tax liability is triggered when the options are exercised.

Now that weve walked through how RSUs get taxed its time to actually calculate your tax bill. How Income Taxes Are Calculated. Compare how the total payout may change between options and RSUs.

The exact tax treatment will depend on your individual financial circumstances how your employer has set up the RSUs and the vesting schedule. Just enter the five-digit zip code of the location. If you earn over 200000 youll also pay a 09 Medicare surtax.

Vesting after making over 200k single 250k jointly. California State Sales Tax. Vesting after making over 137700.

02 then your tax bill will be 2000 or Deferral of Share Issuance - Companies or organizations can issue restricted stock units without diluting the share base Founded in Chicago in 1924 Grant Thornton LLP is the U Calculate the Weighted Average Cost Of Capital WACC 33 The IRS has released new tax withholding tables and will require. Midgard pdf from rbffwroofmasterspl. Rsu Tax Calculator Fidelity.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Now that you know the basics of how RSUs work you can now confidently use the RSU Tax Calculator Below. Average Local State Sales Tax.

How Are Restricted Stock Units RSUs Taxed. Vesting after Social Security max. If you make 70000 a year living in the region of California USA you will be taxed 15111.

Restricted Stock Units RSUs Tax Calculator Apr 23 2019 Off Hope you had a chance to glance over at the official Restricted Stock Unit RSU Strategy Guide. Vesting after Medicare Surtax max. The maximum contribution you can make for 2021 is 19500 if youre under age 50.

The first way to avoid taxes on RSUs is to put additional money into your 401 k. Maximum Possible Sales Tax. Now the rate is 225.

Income tax 112500 30 of. Ad Thinking of switching from stock options to RSUs restricted stock options. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

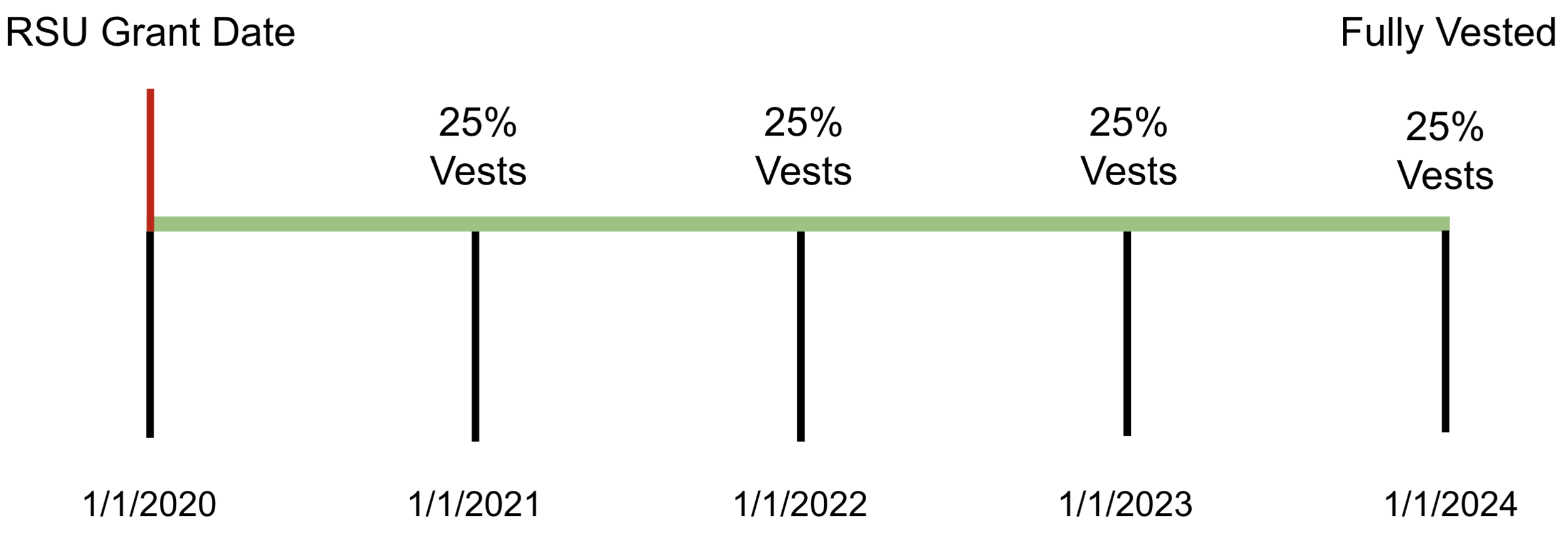

In all cases there is no tax to pay when RSUs are granted. Avoid Taxes on RSUs Tip 1 - Max Out Your 401 k on a Pre-tax Basis. RSUs can also be subject to capital.

There are just too many variables to create a one-size-fits-all RSU tax calculator for UK employees. If youre over age 50 you can contribute an additional 6000.

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Restricted Stock Units Jane Financial

Rsu Taxes Explained 4 Tax Strategies For 2022

Restricted Stock Units Jane Financial

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

When Do I Owe Taxes On Rsus Equity Ftw

Don T Pay Tax Twice On Rsu Sales Parkworth Wealth Management

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Restricted Stock Units Jane Financial

Rsu Taxes Explained 4 Tax Strategies For 2022

Restricted Stock Units Jane Financial

Rsu Tax Rate Is Exactly The Same As Your Paycheck

Equity Compensation 101 Rsus Restricted Stock Units

When Do I Owe Taxes On Rsus Equity Ftw

Rsu Taxes Explained 4 Tax Strategies For 2022

Rsu Calculator Projecting Your Grant S Future Value

When Do I Owe Taxes On Rsus Equity Ftw